Across multiple sectors, we’re observing familiar warning signs for mid-market ecommerce brands (£500k–£5m revenue). Traffic is soft, revenue is down, and average order value (AOV) is taking a hit. If this resonates with you, you’re not alone.

So, what’s happening, and what does it mean for your business?

1. UK Retail & Ecommerce Trends

Nationally, retail sales have contracted for 11 consecutive months. Ecommerce sales are up just 4.6% YoY, and AOV sits around £109, with consumers cautious about committing to purchases.

This matches what we’re seeing in our own client dataset: healthy engagement, but a growing “browse now, buy later” pattern.

2. What the Data Tells Us (Infinity Nation Blended Report)

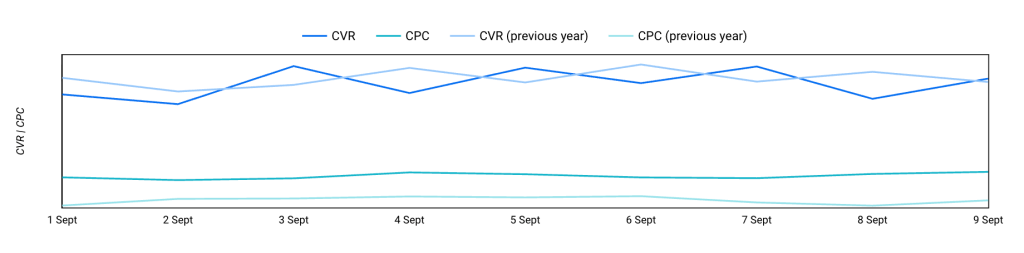

Google Ads

- CPCs up 9% / CPMs up 34% → More competitive auctions despite softer demand.

- CTR up 23% → Appetite remains strong; people are still interested.

- CVR down 14.5% → Consumers hesitate to purchase, browsing before buying.

Takeaway: Google is still a strong traffic driver. The gap between clicks and conversions shows consumer caution — interest is there, but intent is delayed.

Meta

- CPCs up 77% / CPMs up 24% → Paid social is dramatically more expensive YoY.

- CTR up 14% → Creative is resonating; demand is healthy.

- CVR down 30% → Harder to convert social traffic; cost per acquisition rising.

Takeaway: Meta is driving growth and revenue, but efficiency is dropping. Spend and engagement are high, but conversions aren’t keeping pace.

Why This Matters

For Marketing Directors/CMOs:

- Efficiency is eroding — more budget is needed for the same or fewer conversions.

- Payday behaviours are sharper — more purchases cluster around month-end, making mid-month results look artificially weak.

For Marketing Managers:

- Creative is cutting through — strong CTRs mean ads are working.

- Conversion strategy needs sharpening — UX, checkout flow, and remarketing are critical to bridging the “browse now, buy later” gap.

4. Turning Insights into Action

Now (next 30 days)

- Align campaigns with payday weekends – expect stronger performance at month-end.

- Review landing page speed and checkout friction; don’t waste the traffic you’re paying more to attract.

Next Quarter

- Reallocate budget to balance rising CPCs/CPMs; shift spend to channels delivering best marginal return.

- Test bundling or urgency messaging to bring hesitant shoppers forward.

Next Year

- Plan for a higher cost baseline in paid media. Build margin through efficiency and AOV strategies, not expecting CPCs to ease.

By reallocating budget and improving efficiency, your team frees up time to focus on what matters most, serving your customers and driving measurable growth.

5. Next Steps for Senior Ecommerce Leaders

We know Q4 can make or break your year. That’s why we’re offering two ways to act now:

1) Join our Ecommerce Collective:

- Spaces available for September and October in London, Wiltshire, and Virtual sessions.

- Collaborate, learn, and benchmark with peers facing the same challenges.

2) Book a Discovery Call

- Our team will audit your current strategy, identify gaps, and mark homework ahead of Q4.

- Walk away with a clear plan to protect revenue and maximise growth.

The Opportunity

Ecommerce may be under pressure, but opportunity still exists. By focusing on efficiency, conversion, and targeted growth, you can turn uncertainty into a clear path forward.

Your next step is simple: join the Collective or book a Discovery Call today — Q4 won’t wait, and neither should you.

DO YOU WANT TO PUSH YOUR DIGITAL GROWTH STRATEGY FORWARD? LET’S CHAT.

Interested in working with INFINITY NATION to create a successful digital experience for your company or product?

Get in touch to set up a meeting with our team.