Black Friday has changed, and the difference between 2025 BFCM and 2024 makes it clear that the shopping holiday is evolving.

At Infinity Nation, we analysed November performance across both years. What emerged was a shift not just in results, but in strategy. While 2024 delivered sharp, high-impact spikes, 2025 took a more controlled and effective approach – a distinction that matters for brands planning future peak periods.

From Early Spikes to Smarter Pacing

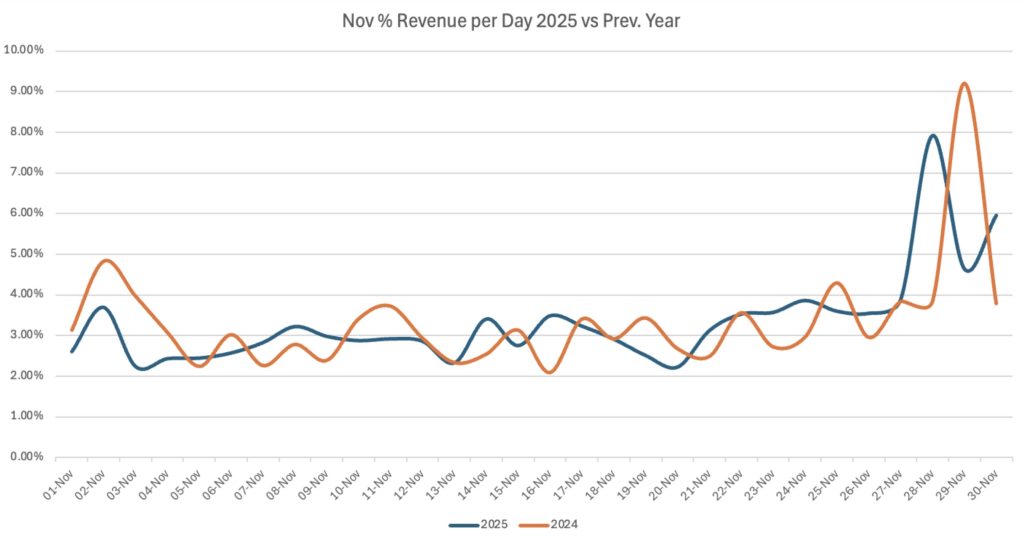

Early November 2024 was marked by ups and downs. There were strong peaks in the first few days, especially on the 2nd and 3rd of November. Aggressive demand pulled forward, creating early wins but resulting in less control later.

In contrast, 2025 started more softly and consistently. Daily performance was smoother, suggesting brands paced activity more deliberately. Rather than exhausting demand early, restraint proved more effective in preserving momentum for peak.

Stability Through Mid-Month

Performance in 2024 fluctuated noticeably, pointing to reactive campaign bursts. In 2025, trading remained steady throughout the middle of the month. This consistency reflects stronger planning, greater stock confidence, and less reliance on last-minute promotions – all helping to control acquisition costs ahead of Black Friday.

Building Momentum Before Black Friday

The most meaningful difference appeared in the week leading up to Black Friday.

In 2024, there was little evidence of momentum building, with demand heavily concentrated on the day itself. In 2025, performance rose steadily in the days beforehand, showing that earlier messaging and warm-up activity successfully prepared consumers to convert.

Instead of relying solely on urgency, brands focused on readiness.

A Full Weekend, Not a Single Day

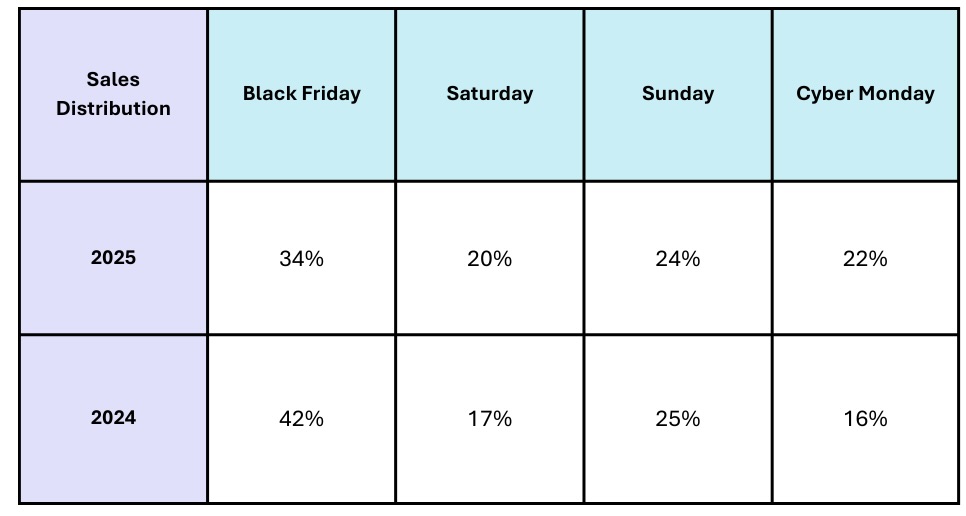

In 2024, 42% of Black Friday and Cyber Monday (BFCM) revenue landed on Black Friday alone, with comparatively weak supporting days. In 2025, revenue was far more evenly distributed across the entire weekend including a much stronger Cyber Monday.

This balanced approach reduces risk, protects margins, and captures value beyond impulse purchases.

Search Demand Peaks Then Drops Fast

While Black Friday itself delivered strong results, Google search demand collapsed rapidly once the event passed.

Search activity fell by around 15% year-on-year outside the core sale window, with especially weak performance on Cyber Monday and the days following. Consumer intent now peaks sharply on Black Friday and then drops off quickly.

Brands that rely on search need to take action. They should concentrate their efforts during the main Black Friday period. This will help them meet demand effectively.

Conversion Depends on Product Information

As demand becomes more concentrated, conversion efficiency matters more than ever.

High-quality product information can increase sales by up to 25%, and 68% of shoppers say reliable details strongly influence buying decisions. In high-consideration categories like furniture, accurate product content doesn’t just drive higher conversion rates – it also reduces returns.

When shoppers are ready to buy, there’s little room for friction.

Social Media’s Growing Role in Home Shopping

Social media is now a major revenue driver for home shopping, not just an awareness channel.

Facebook, Google, and Instagram remain the top-performing traffic and sales platforms, with influencers and social content playing an increasingly important role in shaping purchase decisions. By the time Black Friday arrives, many consumers have already discovered, compared, and shortlisted products.

Brands investing in social-led discovery earlier in November are better positioned to capture high-intent shoppers when peak demand hits.

The winning formula:

- Win early by pacing, not spiking

- Win at peak by being visible when demand is highest

- Win overall by converting efficiently when shoppers are ready

What Happens Next

The brands that win long-term are the ones that analyse what happens next – specifically, how the customers acquired during BFCM behave over the following 12 months. Cohort analysis at this stage is critical. With acquisition costs at their highest during peak, Black Friday profitability is ultimately defined by lifetime value, not day-one ROAS.

Understanding what these new customers go on to do, how they re-purchase, how they respond to email, and how quickly they build brand affinity will make or break next year’s planning cycle.

Black Friday success is no longer about one frantic day. It’s about building momentum, capturing intent at the right moment, converting efficiently, and then nurturing those customers into long-term value.

Brands that understand this shift are turning Black Friday from a stressful scramble into a repeatable growth engine.

Looking for help with building your 2026 Marketing Strategy?

We can help. Contact: chat@infinitynation.com

DO YOU WANT TO PUSH YOUR DIGITAL GROWTH STRATEGY FORWARD? LET’S CHAT.

Interested in working with INFINITY NATION to create a successful digital experience for your company or product?

Get in touch to set up a meeting with our team.